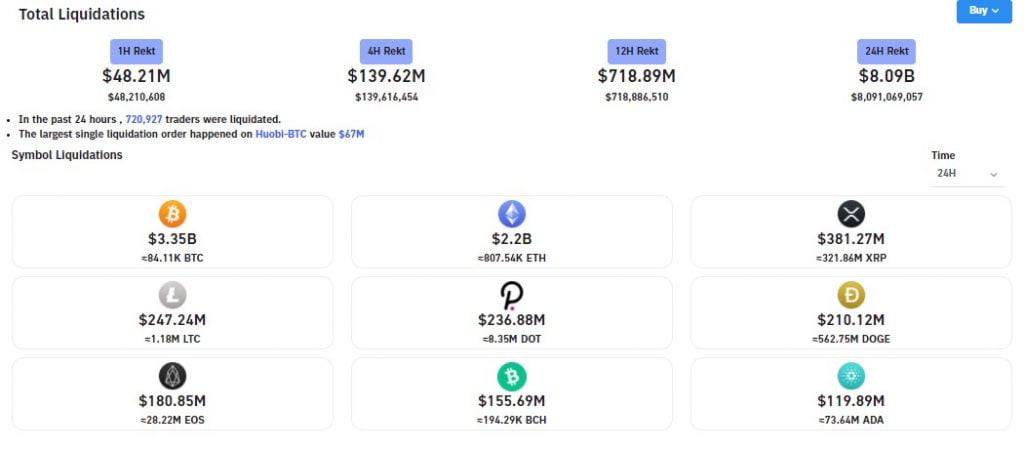

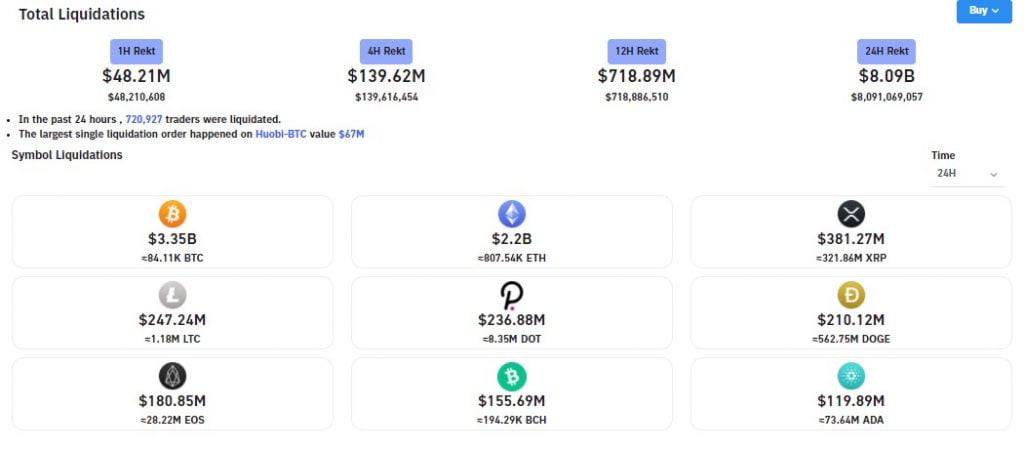

Bitcoin’s Dip to $30k Caused $8.09B in Liquidations in the last 24hrs

$8.09 Billion in buying and selling positions were liquidated within the ultimate 24 hours720,927 crypto investors were liquidated within the ultimate dayRetail buyers were the primary sellers in the course of the dipThe largest single liquidation was once a Bitcoin place value $SIXTY SEVEN millionBitcoin liquidations top the listing at $3.35 Billion within the remaining dayBitcoin is lately trying to reclaim the $40k toughen

The last 24 hours had been a sea of red as a results of Bitcoin shedding to a local low of $30k from what appeared like solid toughen at the $41k price space. The 27% drop used to be rapid and furious and led to liquidations value $8.09 Billion within the final 24 hours.

In the same time frame, 720,927 crypto buyers have been liquidated with the largest single liquidation of the day being a Bitcoin business price $SIXTY SEVEN million. Bitcoin liquidations made up FORTY ONE% of the liquidations at $3.35 Billion as observed within the screenshot underneath, courtesy of Bybt.com.

Bitcoin Makes An Attempt to Reclaim $40k

At the time of writing, Bitcoin is trading at $39,687 after reclaiming the 50% Fibonacci retracement stage on the $34.3k worth level. On The Other Hand, at its present worth, Bitcoin is dealing with the 2 HUNDRED-day shifting average (green) as resistance on the $40k worth zone. Furthermore, the 38.2% Fibonacci retracement level is also every other barrier to Bitcoin at $FORTY ONE,524 and as observed within the chart below.

Also from the chart, it might probably be noticed that the day by day MACD, MFI and RSI are in overbought territory. These three indicators are hinting towards a potential reversal that would assist Bitcoin in reclaiming the $40k to $42k worth zone within the next few hours.

Retail Sold, But Establishments Held their Bitcoin

According to a report through Chainalysis, retail investors had been a majority of the sellers all over Bitcoin’s meltdown to $30k. Strangely, institutional traders hung on to their luggage with a few even buying the dip. An excerpt from the report explaining the phenomenon can also be found under.

The on-chain information means that retail is selling on exchanges while institutional buyers are simply no longer shopping for as so much as before rather than selling, even though a few have started to purchase the dip as of late…

It additionally doesn’t seem that establishments are important dealers, although they will be more cautious as buyers at the moment. The chart beneath shows that bitcoin inflows into exchanges are slightly low in comparison to previous promote-offs, at 412,000 BTC in the remaining three days, compared to 412,000 on the 13 March 2020 by myself. This suggests that so much of the marketing is from individuals with belongings already on exchanges, who are likely to be retail traders.