ETH’s Top 10 Whales Have Doubled their Holdings in the last 8 Months

Ethereum’s top 10 non-trade whale addresses have doubled their holdings within the last 8 monthsAt the same time, the ETH holdings of the top 10 alternate whales have halved in 7 monthsValue locked on DeFi the usage of Ethereum has doubled in the closing THREE monthsAll those events and knowledge point in opposition to a continuation of Ethereum’s bullish momentum

Ethereum’s most sensible 10 non-trade whales have doubled their ETH holdings within the closing EIGHT months. At the same time, the holdings of Ethereum’s most sensible 10 exchange whales, have halved in the closing 7 months.

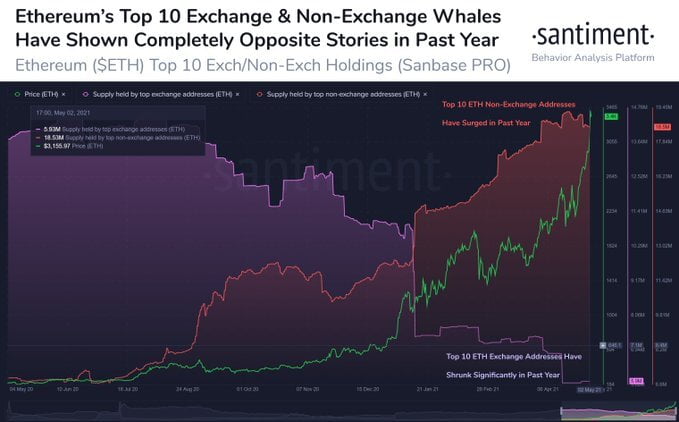

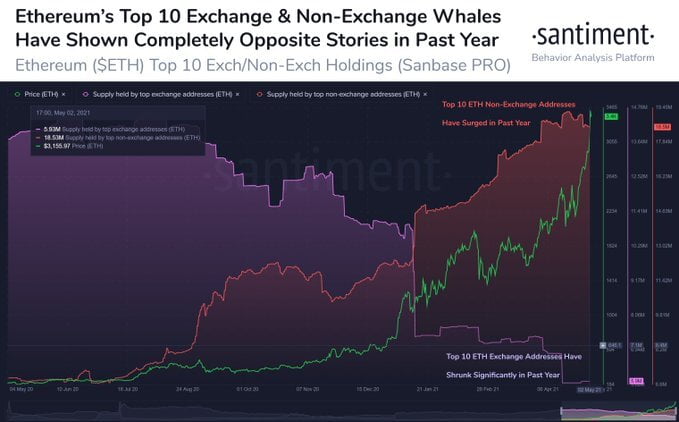

The accumulation and depletion of Ethereum among non-exchange whales and crypto exchanges used to be captured by the staff at Santiment throughout the following statement and accompanying chart.

Ethereum touched yet one more All Time Prime of $THREE,524 a couple of hours ago earlier than losing on a light market-huge correction. Top 10 non-trade whale holdings have doubled within the earlier 8 months, even as the top 10 trade whales halved in the earlier 7 months.

Value Locked in DeFi the use of Ethereum Doubles in 3 Months

As mentioned by the workforce at Santiment, Ethereum has simply posted an all-time high of $3,524. the new all-time prime can also be attributed to more ETH being locked in DeFi in addition to whales accumulating.

In an earlier analysis, the staff at Santiment talked about that the amount of Ethereum locked in DeFi has doubled in the ultimate THREE months. This commentary confirms the mass exodus of ETH out of exchanges and into DeFi, as observed during the following chart.

Ethereum is about to maintain on Rising in Value

at the time of writing, Ethereum is consolidating at the $3,THREE HUNDRED value house after the previous day’s drop to the $3,085 price area. The dip used to be the result of us Treasury Secretary, Janet Yellen, commenting that interest rates might have to extend to offer protection to the financial system from ‘overheating’.

An build up in rates of interest through any Valuable Bank is seen as a way of decreasing inflationary drive via increasing the cost of borrowing and incentivizing saving. Higher rates of interest are likely to have a ripple impact as shopper spending reduces resulting in a slower economy.

However, Ethereum’s fundamentals continue to show promise as illustrated by whales amassing and total worth locked on DeFi proceeding to increase. Therefore, Ethereum’s value will likely keep rising as ETH2.0 is applied.