Bitcoin’s Dip to $50.9k Closes Two CME BTC Gaps

within the closing 24 hrs, Bitcoin suffered a crash from $60,900 to $50,900Over 1 million traders had been liquidated to the song of $10.2 BillionThe dip successfully closed 2 CME BTC GapsThe closure of the 2 gaps created any other at $SIXTY TWO,ONE HUNDRED that would also be stuffed within the long term

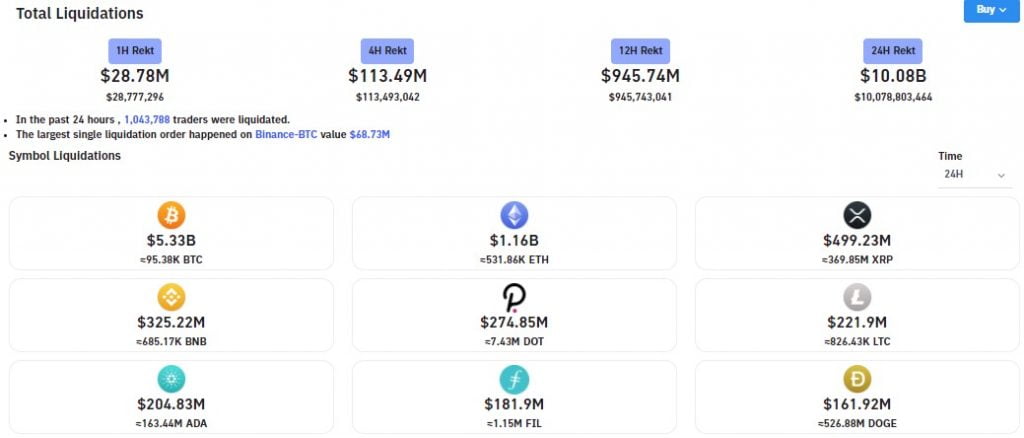

The last 24 hours had been a tumultuous duration in the crypto markets as Bitcoin dropped by means of more or less $10k from $60,900 to a local low of $50,900. The 16.4% Bitcoin sell off in the stated time frame caused the liquidation of 1.073 million traders who misplaced a complete of $10.2 Billion as highlighted by way of the staff at Bloqport throughout the following tweet.

1,073,299 investors liquidated for a complete of $10.2 billion over the earlier 24 hours.

— Bloqport (@Bloqport) April 18, 2021

The Biggest Liquidation was a Bitcoin Order Valued At $68.73 Million

$10.2 Billion in liquidations all the way through a 24 hour time period, is in all probability the highest witnessed to date.

Double-checking the liquidation knowledge on Bybt.com reveals that $5.33 Billion misplaced was once thru Bitcoin trading positions. Moreover, the highest loss used to be a BTC business price $68.73 million. Ethereum traders misplaced roughly $1.16 Billion in trading positions with XRP buyers shedding $499.23 million as highlighted in the following screenshot courtesy of the monitoring web site.

$9.26 Billion in Longs Liquidated

Further breaking down the $10.2 Billion in liquidations, $9.26 Billion price of buying and selling positions liquidated had been long positions. Brief sellers were liquidated to the music of $887 Million in line with Bybt.com.

Dip to $50,900 Closed two CME Gaps, Making A Third at $SIXTY TWO,ONE HUNDRED

One attainable benefit of the rapid dip to $50,900 is that it closed two CME Bitcoin gaps. the first hole was between $59k and $60k with the second one one situated between $55,ONE HUNDRED and $FIFTY FOUR,440 as highlighted within the following chart.

The dip also created a third CME Bitcoin hole again at Friday’s close of $62,ONE HUNDRED FIFTEEN. This in flip foreshadows the possibility of Bitcoin revisiting this price house someday within the long run to fill it. Due To This Fact, Bitcoin may nonetheless have some fuel left in the tank to revisit levels above $60k in spite of the weekly chart hinting of exhaustion.

Theory In The Back Of CME Bitcoin Gaps

With respect to the importance of CME Bitcoin gaps, BTC buyers have for some time, postulated a unfastened thought that each gap created on the CME BTC/USD chart, will likely be full of time.

Gaps are created while the associated fee of Bitcoin reviews a wild swing throughout the weekend, therefore very much deviating from the Friday close at the CME exchange and leaving an opening on the chart as noticed above.

According to the aforementioned thought by BTC traders, Bitcoin’s price will eventually return to the associated fee stage of hole and fill it.