CME Ethereum Futures Volume and Open Interest hit All-time Highs

Quantity and open pastime of the CME Ethereum futures have hit all-time highsCME Ethereum futures quantity has hit 5,469 contracts valued at roughly 273.5k ETHThe open passion has hit 2,462 contracts, which is the equivalent of 123.1k ETHThe information on CME Futures tricks that institutions are bullish on Ethereum

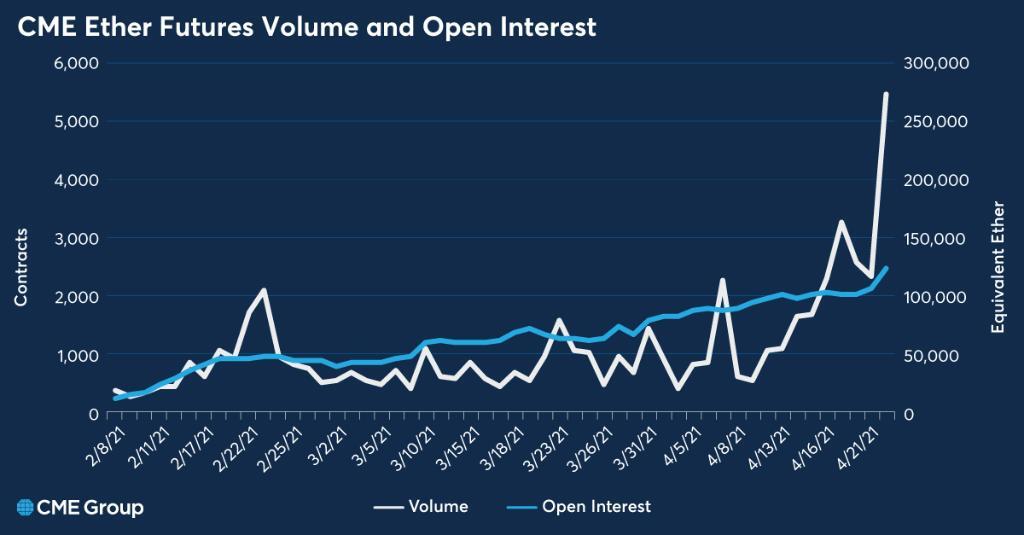

The CME Workforce’s Ethereum futures contracts have hit all-time highs in extent and open pastime. in step with the workforce at CME, the Ethereum futures have hit a report-breaking extent of 5,469 contracts and open pastime of two,462 contracts. The staff at the CME group shared this data throughout the following statement and accompanying chart.

Ether futures trading continues to achieve momentum with two new records set on April 22 — extent reached 5,469 contracts (273.5K similar ether) and open pastime achieved 2,462 contracts (123.1K equivalent ether).

Institutional Interest in Ethereum is Rising

From the chart, it might be observed that the larger volume and open interest on the CME Ethereum futures, is a transparent signal of demand of the buying and selling product from institutional traders.

Also value mentioning is that Ethereum was once trading at kind of $175 one year ago and after the Coronavirus crash of March 2020. Within The similar 12 months, Ethereum may go directly to collect the attention of traders because of the CME Group pronouncing in Q4 of 2020, the release of Ethereum futures in February this year. Ethereum closed 202o at a worth of roughly $750 as a results of the excitement surrounding the futures contracts.

Doing the mathematics, and the use of the current value of Ethereum at $2,THREE HUNDRED, ETH has grown through a factor of 13.14x in three hundred and sixty five days and by means of an element of 3.06x since the beginning of 2021.

From the fast calculations, it might be observed that institutional buyers gaining publicity to Ethereum through the futures contracts has been really useful to the value of ETH. to note is that a number of Ethereum ETFs are already trading in Canada thus injecting additional confidence to establishments which can be ETH as an investment choice.